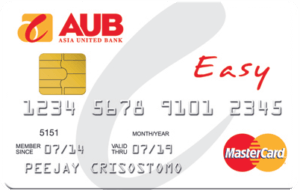

If you’re looking for a credit card that’s going to let you be in control of how much and when you pay, the AUB Easy Mastercard might be right for you. You have the option of paying monthly, bi-monthly or even weekly. You also get to fix your own minimum payment amount.

The AUB Easy Mastercard is a good option for people starting out in the wild, wooly world of credit. It is also good for folks wanting to reestablish their credit. Utilizing AUB’a flexible payment option means, you can pay back your balance on your own terms. If you plan right, you will always have cash around the time of your due date, so you’ll never miss payments, which is great for your credit.

Before applying for a new credit card, you should try to create a plan for your new card. Decide what you will and won’t use it for and what you expect from the card. It is important to weigh factors like interest rates, annual fees, late fees and rewards. Our editors have looked into the AUB Easy Mastercard for you and the details are below. Make sure you read through everything before deciding whether or not this card is right for you.

What are the Benefits of the AUB Easy Mastercard?

As the credit card’s name says, the AUB Easy Mastercard provides an easy way for you to spend the money you need. They also make it easy for you pay them back by allowing you to select which day or days of the month you can best afford to pay the Mastercard bill.

You can select how many times you pay per month. Whether it’s weekly, monthly, or bi-monthly, you’re in complete control. You can even select the preferred date to pay, as well. Your minimum payments will also flucturate depending on how often you decide to pay. For example, if you decide to pay weekly, your minimum payment could be PHP 1000. If you decide to pay monthly, your minimum payment would be PHP 4000. Either way, you get to decide what is right for your lifestyle.

The AUB Easy Mastercard can also be linked to your PayPal so you can deposit your credits easily to your AUB account or even shop online without hassle. For those who love to travel, you earn 1 point for every PHP 20 spent using your AUB card. This also works whenever you shop at multiple establishments in the Philippines and abroad. You can redeem these points for fun stuff with the AUB rewards program.

What are the Fees Associated with the AUB Easy Mastercard Credit Card?

As with any tye of borrowing, you will be required to pay fees for the money you are being lent. With the AUB Mastercard, your annual fee is waived. However, if you do not pay your bills on time, you will be hit with interest and late payment charges.

- Annual Fee – FREE

- Monthly Interest Rate – 3.5% per month

- Late Payment Fee – PHP 700 or the unpaid minimum amount due

If the fees listed above sound like something you can handle. And if you have decided the card offers you the benefits you want, you can find out how to apply below.

How to Apply for the AUB Easy Mastercard Credit Card

Now that you’re interested in getting an AUB Easy Mastercard Credit Card, here are some requirements to take note of. First, you must have a minimum gross annual income of PHP 252,000. Also, you need to be at least 21 to 65 years old upon application. There are other small requirements, like having a mobile and landline phone, which you can read more about on the FAQ page of the AUB website.

For more information about additional requirements, you can apply at your nearest AUB branch or you may visit the official AUB website to apply online. Once approved, your credit limit will be determined based on a number of factors, like your credit history, current income, and expenses.

How to Conact AUB

Head office

Joy~Nostalg Center,

No. 17 ADB Avenue, Ortigas Center

Pasig City, Philippines.

Telephone: 282-8888

Note: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information.