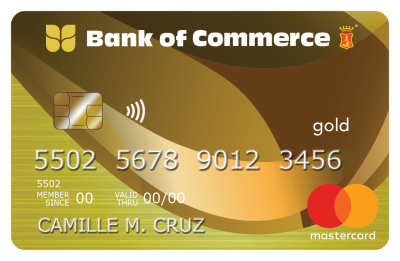

If you want to be rewarded for buying groceries and dining out, the Bank of Commerce Gold Mastercard has got a little something-something for you. The card offers a point for every PHP 25 you spend on groceries. They also give you five times the rewards when you dine at one of their dining partner establishments.

Beyond the points, they don’t expect you to have a crazy-high income like some of the other cards out there. That’s why this is a good card for people starting out in the financial world. Before you decide which card you apply for, make sure you have a clear vision of your goals. It is no good getting a new card, filling it up with useless purchases because that will not help you build your financial health.

It is best to find a card that fits where you are in your life. The Bank of Commerce Gold Mastercard is great if you are starting out and building up. That means, they give you a chance to one day in the future get a card with super high limits and even more rewards. Our team has looked into the Bank of Commerce Gold Mastercard for you and their research is below. Read everything before you decide whether or not to apply.

What are the Benefits of a Bank of Commerce Gold Mastercard?

Bank of Commerce has been one of the Philippines’ leading banks and financial institutions. Since 1963 (originally called as Overseas Bank of Manila), they have been providing financial services and solutions for every Filipino not only domestically but also internationally (for the benefit of Overseas Filipino Workers).

As a way to offer more options for their growing clientele, the bank offers a Gold Mastercard credit card, which you can use to spend on the things you want without the hassle and extra fees.

Love to dine out and discover new shopping venues? Paying for your exquisite meals and items using the Bank of Commerce Gold card gives you more as you earn rewards 5 times more when you use your card at selected establishments.

You can also earn through travel or even filling up gas. For every PHP 25 you spend, you earn one point, which you can exchange for discounts or even awesome freebies offered by the Bank of Commerce.

What are the Fees for a Bank of Commerce Gold Mastercard?

Even your best friend might want a favor after loaning you some money, so credit cards definitely do. Their favor comes in the form of interests and fees you have to pay to use their money. Below we’ve compiled a list of the major charges you need to think about before you decide whether or not to apply for this card.

- Annual Fee – PHP 2,500

- Interest Rate – 3.25% per month

- Cash Advance Service Charge – PHP 100

- Late Payment Charge – Php700 or the unpaid minimum amount due, whichever is lower

If you’re looking for the perfect card that lets you accumulate points for great discounts and freebies, then this is a good card. It’s a good card for people just trying to build their credit rating. And while you earn that credit rating you can also get some point to redeem on stuff you want later.

How to Apply for a Bank of Commerce Gold Mastercard

For you to be eligible for the Bank of Commerce Gold card, you must have at least a minimum monthly income of PHP 38,000 and should be at least 21-65 years old upon applying. The bank only requires you your Tax Identification Number (TIN) and SSS number along with your application. GSIS Number also works.

Once your application has been approved, the credit limit of your card will be determined based on a number of factors, like your credit history, current income, as well as your expenses.

For more information on how to apply for the Bank of Commerce Gold card, you may visit the nearest bank branch, or you may also conveniently apply for one on the Bank of Commerce website.

How to Contact Bank of Commerce

Head office

San Miguel Properties Centre

#7 St. Francis Street Mandaluyong City 1550.

Telephone (02) 632-BANK (2265)

Note: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information.